rhode island income tax withholding

The annualized wage threshold where the annual exemption amount is eliminated. Download or Email RI RI W-4 More Fillable Forms Register and Subscribe Now.

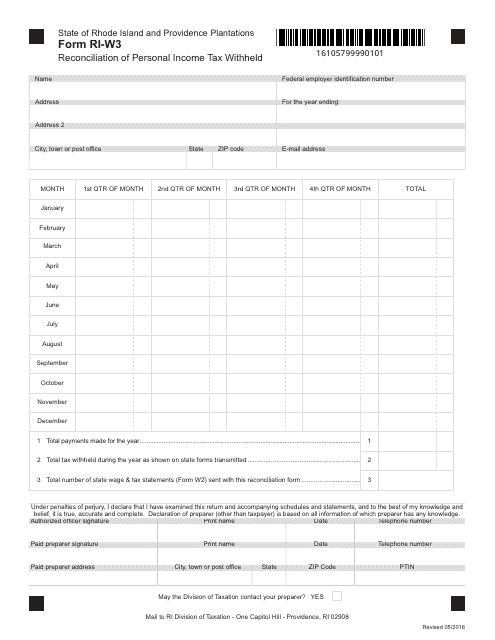

Form Ri W3 Download Fillable Pdf Or Fill Online Reconciliation Of Personal Income Tax Withheld Rhode Island Templateroller

The annualized wage threshold where the annual exemption amount is eliminated.

. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Hold Rhode Island income tax from the wages of an employee if. Rhode Island like the federal government and many states has a pay-as-you-earn income tax system.

An employer may withhold Rhode Island personal income tax at the request of the employee even though the employees wages are not subject to Federal income tax withholding. A the employees wages are subject to. An employer may withhold Rhode Islands personal income tax at the request of the employee even though the employees wages are not subject to Federal income tax withholding.

The income tax withholding for the State of Rhode Island includes the following changes. An employer may withhold Rhode Island personal income tax at the request of the employee even though the employees wages are not subject to Federal income tax withholding. Ad Find turbo tax 2019 business in Kindle Store on Amazon.

REPORTING RHODE ISLAND TAX WITHHELD. UMass employees who reside in Rhode Island use the RI-W4 form to instruct how RI state taxes should be. Rhode Island Income Tax Withholding Certificate RI-W4 RI W-4 2022pdf.

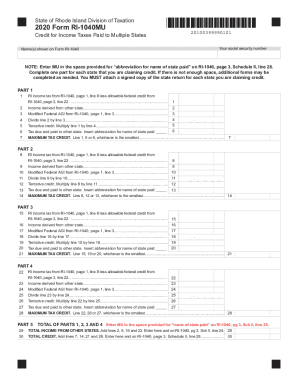

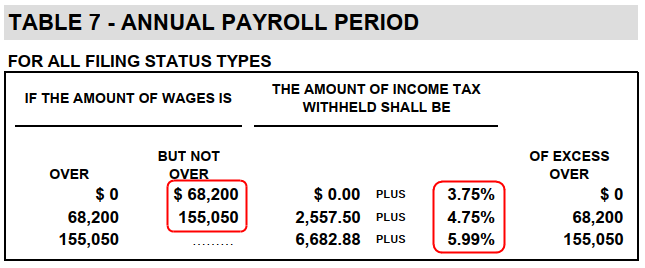

Wages paid to Rhode Island residents who work in the state are subject to withholding. Up to 25 cash back Apart from your EIN you also need to establish a Rhode Island withholding tax account with the Rhode Island Department of Taxation DOT. The income tax is progressive tax with rates ranging from 375 up to.

Employers must report and remit to the Division of Taxation the Rhode Island income taxes they have withheld on the following basis. An employer may withhold Rhode Island personal income tax at the request of the employee even though the employees wages are not subject to Federal income tax withholding. Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax.

Residents and nonresidents including resident and. Ad Fill Sign Email RI RI W-4 More Fillable Forms Register and Subscribe Now. You set up your.

Individuals filing joint Rhode Island income tax returns incur joint and several liability for the Rhode Island income tax. Rhode Island regulatory law provides that a Rhode Island employer must withhold Rhode Island income tax from the wages of an employee if. The income tax withholding for the State of Rhode Island includes the following changes.

The income tax withholding for the State of Rhode Island includes the following changes. Rhode Island income tax must also be withheld from wages paid to Rhode Island nonresident. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three.

Prior Year 941Q Quarterly Withholding Return - ONLY FOR USE FOR PERIODS ON OR BEFORE 12312019 PDF file less. 1 The employees wages are subject to federal income tax withholding and 2 Any part of the wages were for services. If your state tax witholdings are greater then the amount of income tax you owe the state of Rhode Island you will receive an income tax refund check from the government to make up the.

The annualized wage threshold where the annual exemption amount is eliminated. BAR Business Application and Registration PDF file less than 1mb. Under that system employers are required to.

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Resident Booklet Includes Instr And Tax Tables

State Tax Withholding How It Can Vary What You Should Know Payroll Vault

Ri Extends Tax Deadline To May 17 In Line With Irs

Ri W4 Fill Online Printable Fillable Blank Pdffiller

Rhode Island State Tax Tables 2022 Us Icalculator

Ri 1040 Instructions 2020 Fill Out And Sign Printable Pdf Template Signnow

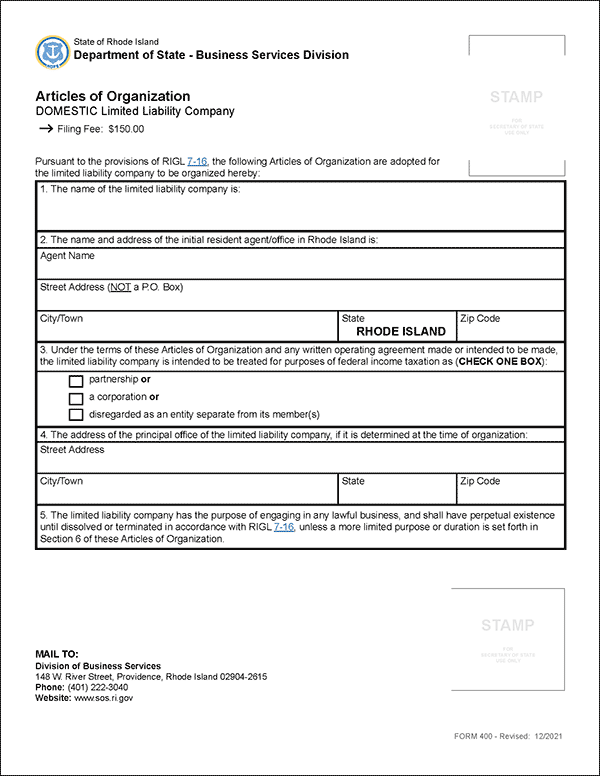

Rhode Island Llc How To Start An Llc In Ri Truic

Rhode Island Income Tax Ri State Tax Calculator Community Tax

State Conformity To Cares Act American Rescue Plan Tax Foundation

Rhode Island Crime News April 2022 The Boston Globe

State Income Tax Withholding Considerations A Better Way To Blog Paymaster

Rhode Island Employer Payroll Withholding Tax Registration Service Harbor Compliance

How To Form An Llc In Rhode Island Llc Filing Ri Swyft Filings

State Withholding Form H R Block

Powerchurch Software Church Management Software For Today S Growing Churches